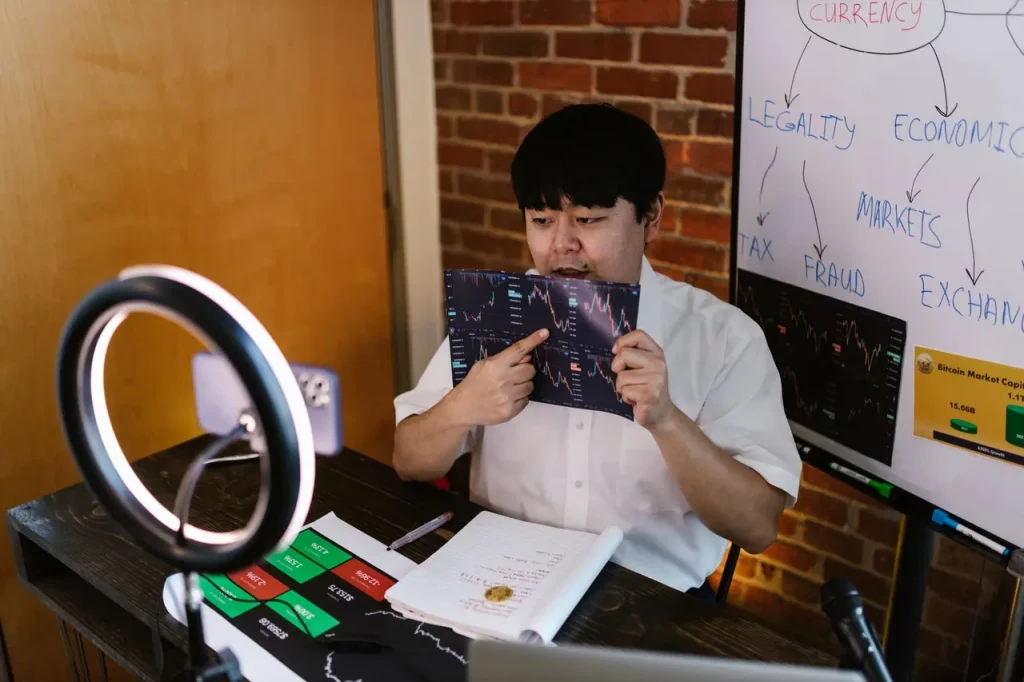

As with many businesses, the psychology of trading stocks is an essential aspect of the Forex industry.

The psychology of the trade is no less important than the skills you need to acquire to operate within the industry or the understanding of the current market conditions.

It’s an integral part of doing well as a trader.

Brokers like Oanda.com have to think carefully and act for the right reasons so that their trades pay off.

Forex trading psychology is crucial to the trader’s mindset. It plays a role in how they manage their emotions throughout the course of a day, how they think, and why they make the decisions that they do. Though many factors contribute to overall trading psychology, there are a few critical stimuli that are the main influences. These include

- Greed

- Anger

- Fear

- Impatience.

In this article, we’ll break these aspects down for you and see how they interact with each other inside the trader’s mind to form different potential outcomes and patterns.

The Four Key Stimuli

Let’s begin breaking down these stimuli and their consequences.

Greed and Impatience:

These two often come as a packaged deal. The “immediate gratification” mindset of wanting to get a payout NOW instead of waiting for a potentially bigger payout has been the downfall of many a trader.

Waiting and ignoring the greed and impatience that scratch away at that door inside your mind is a learning curve in becoming a successful forex trader.

Fear and Anger:

When traders enter transactions from a place of fear, they may feel like taking drastic steps such as liquidating all their funds and holding back from opening new positions.

When decisions like this are made in fear, anger often follows about the loss or the loss of potential income, which leads to rash decisions that can be equally, if not more damaging than ones made in fear.

To overcome these terrible twins, traders must practice how they would respond in different scenarios to prepare their minds for what awaits them in the world of trading.

If a trader has practiced all possible scenarios, they will not be overwhelmed with fear in the heat of the moment.

Keeping a calm, level head on your shoulders is essential to good trading.

A Trader Mindset

Whatever kind of trading you do, your mindset will determine how well you handle the job and how far you can go with it.

All the luck in the world will not make a good trader unless the “trader mindset” is firmly in place.

Of course, you also need all the skills and understanding of the industry to trade, but this mindset is the gear shift that will allow you to ramp things up another level.

Trading psychology is often underestimated, to the detriment of a trader’s business.

A good understanding and application of the stimuli and influences that we are discussing will make or break you in a stressful, high-pressure situation, which is most days in the trading world.

Let us take a closer look at the key stimuli in a trader’s world.

Fear and Anger

You must never forget that you are human, and both fear and anger are natural human responses to certain situations.

While we advise against being too hard on yourself for feeling these as a knee-jerk response, it is essential that you control them rather than them controlling you and your decisions.

Let’s say there is a forex market crash. It would be natural for the fear to tell you that you should act defensively and liquidate holdings and be reluctant to place new positions.

If you were to become angry with yourself for this reluctance or a loss, your perception and judgment would become clouded, and any immediate decisions made would be emotional instead of logical ones.

Some mental exercises such as pausing and becoming calm before making any big decisions will take you a long way in these moments.

That pause may allow you to identify what drives your decision-making process and avert disaster.

Impatience and Greed

A big misconception about trading that can lead to impatience and fuel greed is that trading is a “get rich quick” business.

Sustainable, long-term trading requires staying power and forethought and the ability to accept smaller wins over a long period.

Trading is a long game. If you increase your position too much, you risk a larger loss.

Greed is another natural human emotion that factors in here as well. Don’t yield to your whims; stick to your carefully thought-out strategy.

Helpful Tips

- Figure out your trading personality. If you’re stable, you’ll know you can rely on yourself in good times and bad. If you’re impulsive, plan to avoid that kind of decision-making.

- Set out a trading plan and follow it through. This eliminates the need for emotional or split-second decision-making.

- Don’t expect to get rich quickly because you most likely won’t.

- Don’t give in to greed. Remember that the market won’t always be in your favor, and you won’t respond as negatively to losses.

Wrap Up

And there you have them; the basics of Forex trading psychology! Use them well, and you’ll go far.