Managing the finances of a small business can seem like an unending battle.

While most entrepreneurs think that their financial situations will change as their companies grow and develop, this isn’t always the case.

When you speak with a money mindset mentor, you’ll realize that financial management for a small business entails thinking ahead and avoiding being complacent.

You should check all financial angles, keep track of everything, and continue learning to maintain stability and financial progress. Remember that your small business’s financial progress reflects your personal wealth.

And as a business owner, you must take all measures to ensure that your organization stays in good financial health if you want it to survive long enough to generate the desired profit margins. It isn’t an easy task, for sure. However, it isn’t impossible to achieve either.

To this end, here are some financial management strategies for small businesses.

Keep an eye on your fixed costs

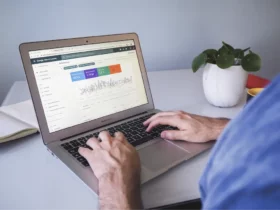

One of the reasons why many small business owners struggle with their finances is that they don’t give their bookkeeping tasks enough attention.

It may be a tedious and time-consuming task, but even with the services of a professional accountant, it is always good standard practice to monitor your outgoings and incomings regularly.

Not only will you keep yourself from overspending. But it will also shed some light on expenses that you can potentially cut costs on.

Also, you can get advice for Toronto Tax Accountant who can help you handle your taxes and minimize costs. The important thing is to stay on top of your finances.

Never assume price points

Another common mistake for small businesses is that they underestimate costs whenever they establish price points.

After all, doing so will make you more susceptible to incurring financial losses because there’s a chance that the cost for your offerings outweigh the prices that they are being sold for.

It is for this reason that you must regularly assess them whenever new goods or services are added or changes are made to the business model.

While you want to establish good, long-term business relationships with suppliers, it’s crucial to compare vendors at least every six months. In this way, you can haggle for a lower price for your raw materials and supplies when the market prices decline.

Don’t buy until you’ve shopped around

There’s no denying that making purchases is inevitable in business.

However, you must always take the opportunity to shop around first before you make a financial commitment for any products or services.

After all, you won’t find money-saving deals if you spend on the first thing that comes up.

And this can make a difference more than some might think because the money you save now will translate to higher profits later on

Let’s say you’re in need of captioning solutions. If you give yourself some time to compare your options, you’ll be able to find services like CART captioning that can give you what you need at reasonable rates.

Don’t spend on non-essential things

Startup business owners tend to have one bank account for everything, which includes personal savings and incoming business profits. If you’re one of them, you’d better act promptly. Open a separate bank account for your business. In this way, you can avoid spending on non-essential things.

As a business owner, it is easy to get caught up with the excitement and spend on things that the business may not necessarily need. For instance, it might be impractical to spend on expensive furniture pieces to impress your customers, especially if you haven’t included them in your initial budget plan.

Even the smallest expenses can put a sizable dent in the bank if it is left unchecked.

So before you make a purchase, always assess whether or not it is something that can move the company forward.

If it doesn’t have any impact on operations, it is best to leave it be.

It isn’t easy to successfully manage the finances of a small business, but it is necessary to succeed.

Takeaway

By following these tips, you should be able to bring your operational costs down to a reasonable level and maintain healthy profit margins as a result.

If you want to have a successful small business, make sure to continue honing your knowledge and skills in financial management by taking online business courses and consulting a financial coach to help you make sound decisions.